Trash and recycling will be picked up Monday, September 1st as scheduled.

🚛 The only holidays with no service are:

Christmas

Thanksgiving

New Year’s Day

City Council: https://www.mychoctaw.org/documents/government/agenda-center/city-council---choctaw-utilities-authority/2025-council%2Fcua-agendas/737643

CEDA: https://www.mychoctaw.org/documents/government/agenda-center/choctaw-economic-development-authority-(ceda)/2025-ceda-agendas/737647

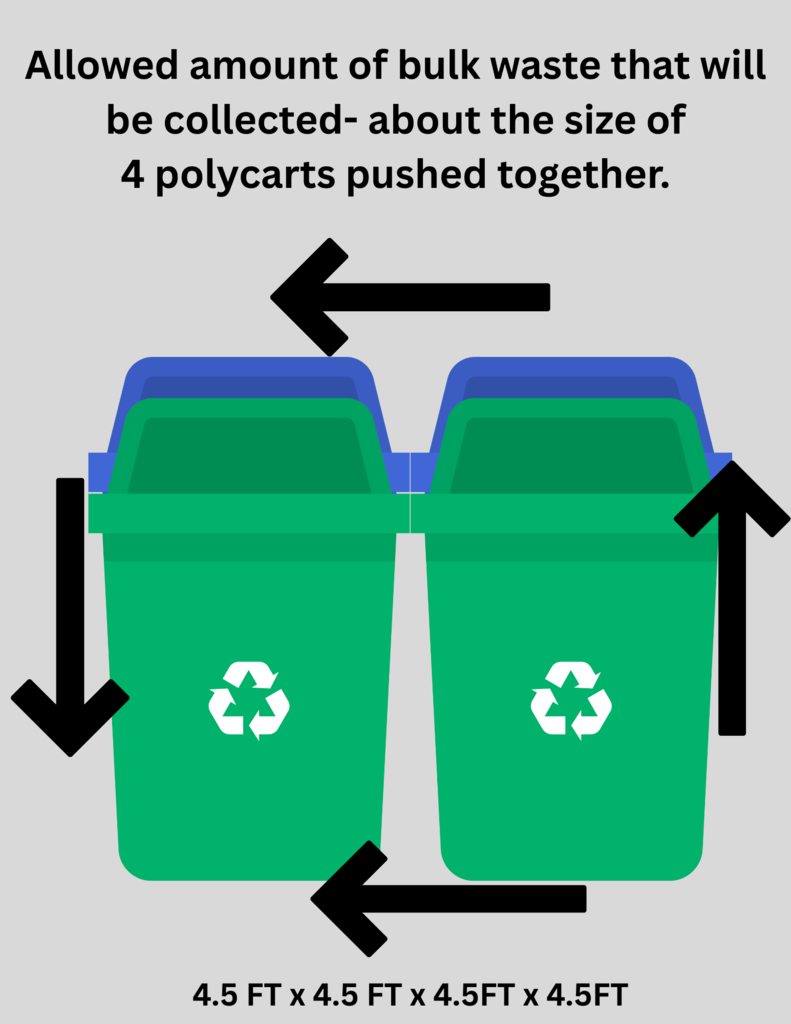

♻️ Bulk Trash Reminder

The rules have changed! Waste Connections will now pick up 3 cubic yards (4.5 FT x4.5 FT x4.5 FT x4.5 FT) of bulk trash. That is about the same size as four Poly-carts.

Did you know you can search for the burial site of a loved one on The City website? If you would like to locate the grave of a loved one, go to https://www.mychoctaw.org/page/elmwood-cemetery

scroll to “Look Up a Grave,” and click the “View Aerial Map” link.

The next City Council/CUA meeting will be held on Tuesday, August 20, 2025 at 6:00 pm at City Hall. Agendas can be found on the City website at https://www.mychoctaw.org/documents/government/agenda-center/city-council---choctaw-utilities-authority/2025-council%2Fcua-agendas/737643

🛍️ Garage Sales Are Posted!

This weekend’s garage sales are now listed on our website—check them out and plan your stops!

If you’re having a garage sale this weekend, be sure to come in and get registered before 11:30 AM tomorrow.

Reminder: City offices close at 11:30 AM every Friday.

https://www.mychoctaw.org/o/choctaw/page/garage-sales

Water Line Leak Notice

There is currently a water line leak at Buckwood & Tenth Street.

Homes most likely to be affected include those on:

🏠 Buckwood

🏠 Twisted Oak

🏠 Sandy Lane

🏠 6th Street

Residents in these areas may experience no water for approximately 4–6 hours while repairs are made.

We appreciate your patience as our crews work to restore service as quickly and safely as possible.

Crews will begin work at 7:00 AM, starting on the north end and moving south. Please expect delays and limited access — it may be difficult to get through the area during construction.

Our red dirt road nostalgia is coming to an end! Thank you for your patience as we make these much-needed improvements.

Please note that the article in the August Newsletter regarding back-to-school dates listed the incorrect days of the week. However, the dates themselves are correct.

For the most accurate and up-to-date information on school happenings, be sure to follow your student’s school on its official social media pages. Each school shares important updates, announcements, and event details throughout the year (and they get the days right).

Thank you for your understanding!

Water service on Maupin will be temporarily shut down to repair a leak.

This process is expected to take approximately 4–5 hours.

We appreciate your patience as crews work to make the necessary repairs.

Thanks to the hard work of Ward 6 Councilperson Rick Modisette and the full City Council, the new school zone signs were installed just in time for the new school year!

School starts soon — so please slow down, watch for kids, and be mindful when those flashing lights are on. Let’s work together to keep our students safe!

The City of Choctaw is currently accepting applications for open positions!

View current job openings here: https://www.mychoctaw.org/o/choctaw/page/jobs